Quantifying access: How copay design impacts UC ROI

December 9, 2025

Urgent Care access and the role of copays

Studies have shown that cost is a proven barrier to care: 25% of adults have postponed seeking care because of associated costs.2Telehealth-based urgent care exists to deliver fast, cost-effective access to timely care for one-off health needs, but it’s only cost effective when used.

Postponing care often leads to more serious conditions that require higher-acuity and higher-cost interventions such as emergency room visits. This increases total spend for health plans and employers and negatively impacts member outcomes.

While insurance coverage helps reduce overall member costs, the copay benefit design remains a decisive factor. High copays increase the likelihood that patients will delay care, but lower copays can reduce or remove this barrier entirely, improving access and outcomes.

MD Live by Evernorth analyzed more than 1.5 million urgent care visits to understand the impact of copay design. These findings highlight the powerful relationship between copay structure and member behavior.

- 2

https://www.kff.org/health-costs/issue-brief/americans-challenges-with-health-care-costs/

Key Finding 1: Increased appropriate utilization of care

We hypothesized that members are significantly more likely to engage with urgent care when cost is eliminated as a barrier.

According to our analysis, members with no financial responsibility were nearly three times as likely to utilize the benefit compared to those with a copay, underscoring that copay design is a decisive factor in member engagement.

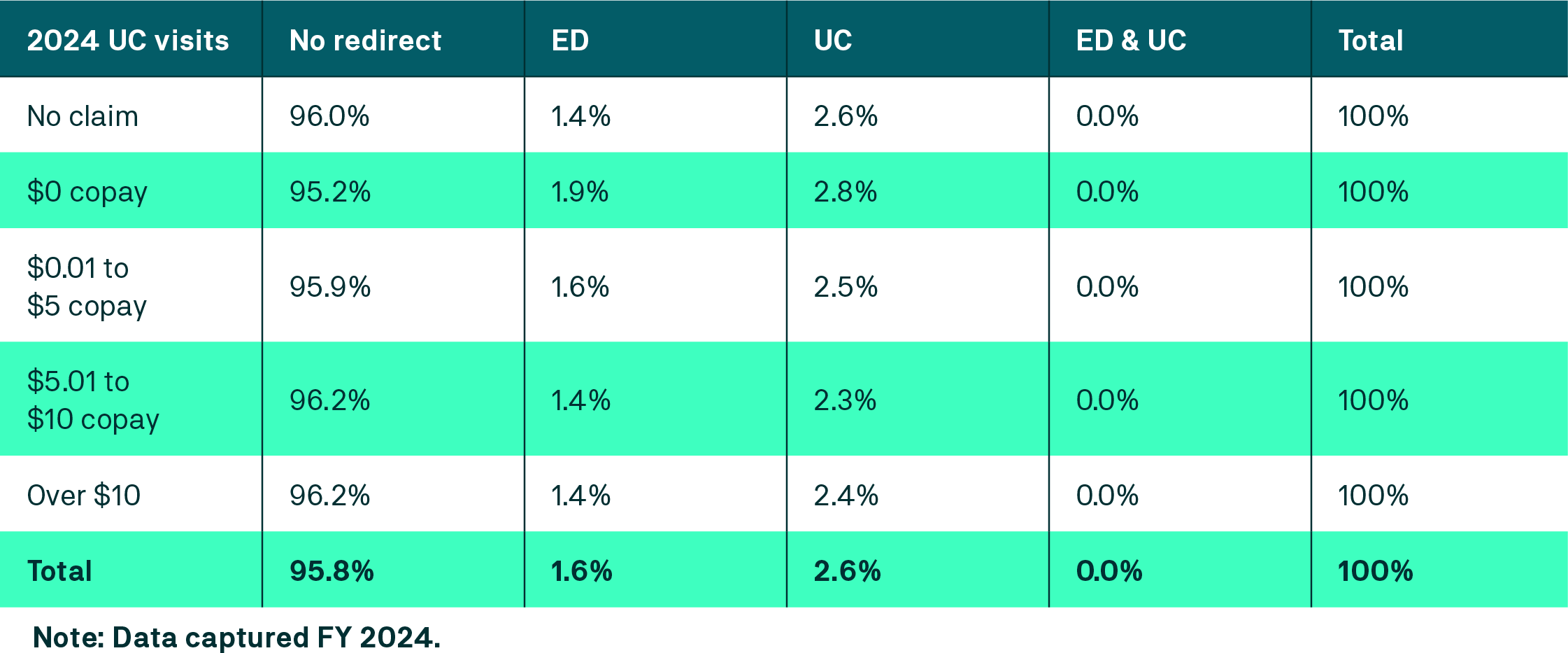

Key Finding 2: Redirect levels remain appropriate

A common concern with lowering or eliminating copays is the potential for excessive redirects, which can signal improper utilization and increased costs. Our analysis shows this is unfounded.

To evaluate this risk, we analyzed redirect rates, defined as cases in which an urgent care physician directed a member to another setting because virtual care was not appropriate. Differences in redirect rates remained negligible, confirming that members were using urgent care appropriately even if cost barriers were removed.

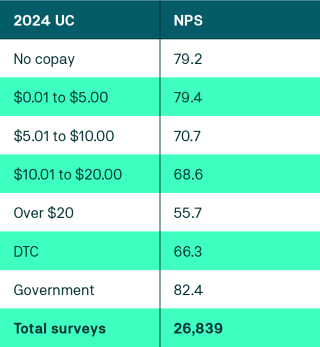

Key Finding 3: Copay structure is correlated to a higher NPS

A key indicator of patient experience is Net Promoter Score (NPS). A high NPS not only reflects a patient’s satisfaction with care, but also shows they would recommend the service to others. This makes NPS a positive indicator for member retention and engagement.

For clients with a $0 copay, our analysis showed there was a drastic improvement in NPS scores when compared to those with even a $10 copay. This signals that $0 dollar copays may be more than just a cost-management tool, but a powerful driver of member experience and brand equity for health plans and employers.

A high NPS doesn’t just translate to more satisfied members — it can also result in better plan performance overall.

Take Medicare Advantage plans, for instance. As of 2023, Consumer Assessment of Healthcare Providers & Systems (CAHPS) scores make up 57% of the STAR rating. At the heart of CAHPS scores is patient experience, broken down into categories including:

- Getting Needed Care

- Getting Appointments and Care Quickly

- Rating of Health Plan

Our analysis shows that lowering or eliminating copays improves these measures by making care more accessible and reducing friction in the member experience, resulting in better financial performance and more ROI for the health plan.

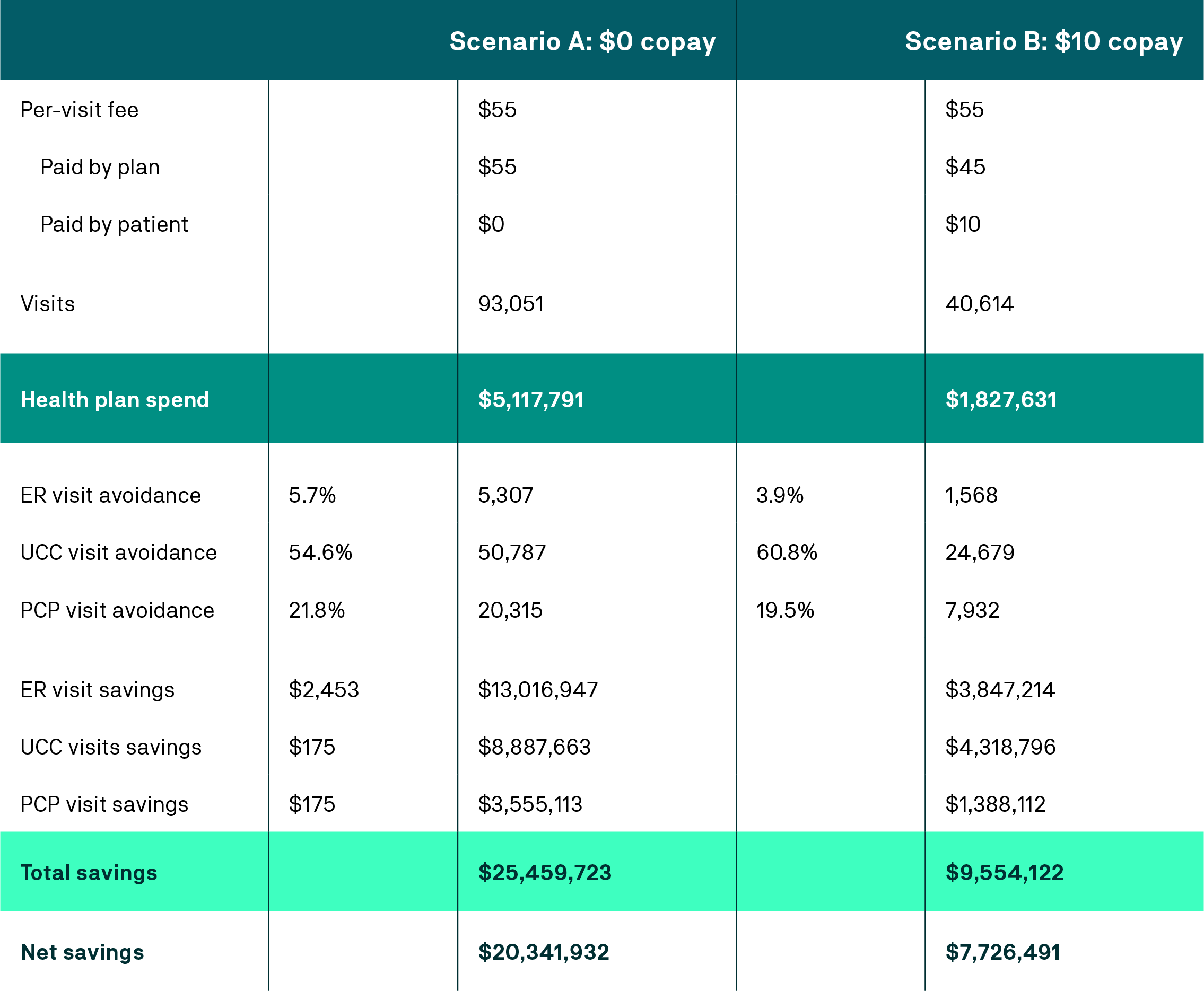

Key Finding 4: Real-world savings

Improved utilization, improved NPS scores, and fewer redirects are clear wins for members, health plans, and employers. But strategic copay design can also translate to additional, real-world savings for the payer.

To illustrate the impact, we modeled a scenario comparing $0 and $10 copays. The results indicate a significant ROI advantage for plans that remove cost barriers for urgent care telehealth, reinforcing that copay design is a strategic lever for cost management.

As the above scenario shows, a $0 copay can result in savings nearly three times greater than those found with a $10 copay.

The relationship is clear: as the copay increases, utilization drops, reducing the likelihood members utilize lower-cost virtual urgent care.

Lower copays: A net positive for healthcare

Our analysis illustrates that lower copays improve access, increase satisfaction, and generate measurable ROI — without driving inappropriate use. For health plans and employers, this means tangible cost savings and improved performance metrics. For members, it means more accessible care, especially in underserved areas where access remains a persistent challenge.

- There are 80% of rural Americans in a medical desert.3

- 21% of adults without vehicles struggle to get the care they need.4

- A record-high percentage of Americans are unable to pay for care.5

Reducing or eliminating copays is not only a benefit design choice, but a strategic lever that aligns member experience with real cost savings.

- 3

https://nihcm.org/publications/rural-health-addressing-barriers-to-care?token=NNjzxNvGVakaX3oWp7riCkXFfI44VqFx

- 4

https://www.wsiltv.com/news/consumer/why-medical-deserts-are-on-the-rise-and-how-patients-there-are-accessing-in-person/collection_04e1225b-5085-52de-a6ee-e0a514b174e0.html#2

- 5

https://www.wsiltv.com/news/consumer/why-medical-deserts-are-on-the-rise-and-how-patients-there-are-accessing-in-person/collection_04e1225b-5085-52de-a6ee-e0a514b174e0.html#2

120-5409-25